Browsing the Registration Process for Medicare Advantage Insurance

As people come close to the stage of considering Medicare Benefit insurance, they are met with a maze of options and regulations that can sometimes really feel frustrating. Allow's explore just how to successfully browse the enrollment process for Medicare Benefit insurance coverage.

Eligibility Demands

To receive Medicare Benefit insurance policy, people need to satisfy specific eligibility demands laid out by the Centers for Medicare & Medicaid Services (CMS) Qualification is mainly based on elements such as age, residency condition, and enrollment in Medicare Part A and Part B. Most individuals aged 65 and older receive Medicare Advantage, although specific people under 65 with qualifying handicaps may also be eligible. Additionally, individuals have to live within the service location of the Medicare Benefit plan they want to enlist in.

Furthermore, individuals need to be enlisted in both Medicare Component A and Component B to be eligible for Medicare Benefit. Medicare advantage plans near me. Medicare Benefit strategies are required to cover all solutions offered by Original Medicare (Component A and Component B), so enrollment in both components is required for people seeking protection via a Medicare Advantage strategy

Coverage Options

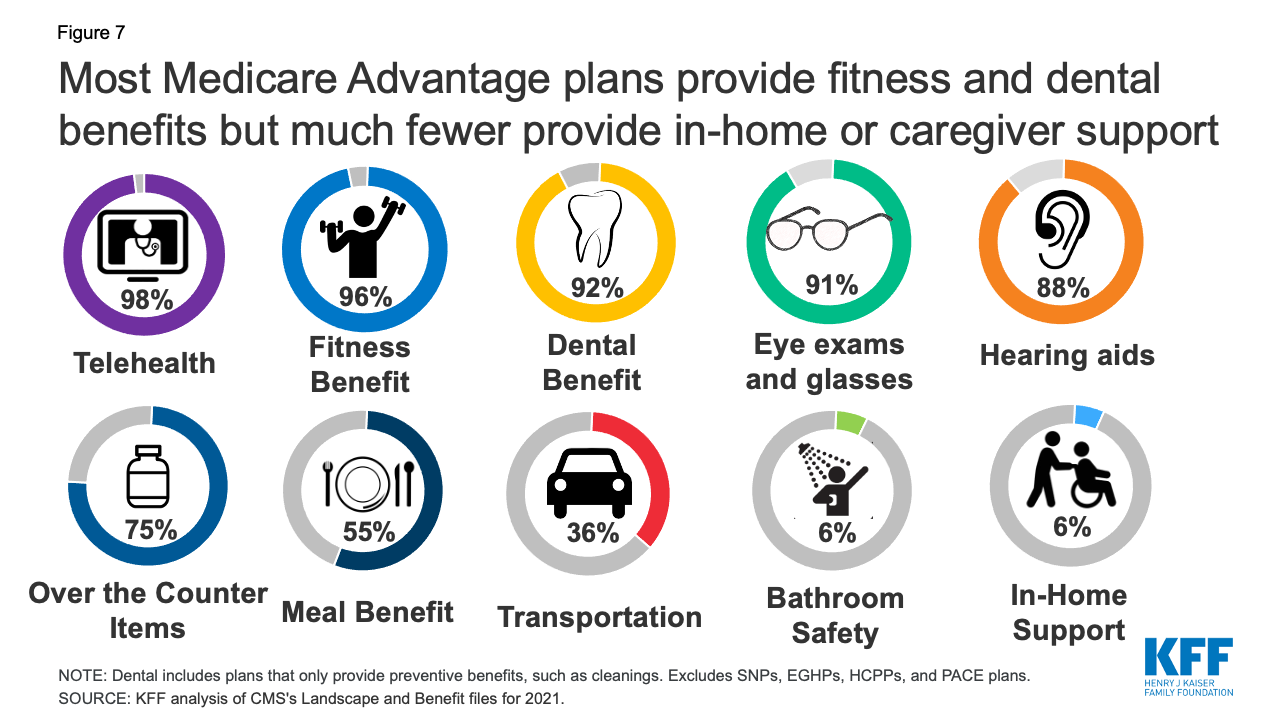

Having actually met the qualification needs for Medicare Advantage insurance, people can currently check out the numerous coverage choices offered to them within the plan. Medicare Benefit prepares, also called Medicare Component C, provide an "all-in-one" alternative to Original Medicare (Part A and Part B) by supplying fringe benefits such as prescription medicine protection (Component D), vision, dental, hearing, and health programs.

Among the key coverage alternatives to take into consideration within Medicare Advantage plans is Health care Company (HMO) plans, which typically call for people to select a health care medical professional and get referrals to see professionals. Preferred Company Company (PPO) prepares offer a lot more versatility in picking doctor without references but frequently at a greater price. Unique Needs Plans (SNPs) deal with individuals with particular health and wellness problems or those that are dually eligible for Medicare and Medicaid (Medicare advantage plans near me). Private Fee-for-Service (PFFS) plans figure out just how much they will pay health care companies and exactly how much people will pay when they get care.

Comprehending these protection alternatives is you can try here important for people to make enlightened choices based upon their healthcare requirements and choices.

Enrollment Periods

Actions for Enrollment

Understanding the registration periods for Medicare Advantage insurance policy is critical for beneficiaries to navigate the procedure effectively and effectively, which starts with taking the needed steps for registration. The primary step is to determine your eligibility for Medicare Benefit. You need to be enrolled in Medicare Part A and Part B to get approved for a Medicare Advantage plan. When eligibility is validated, research and contrast available strategies in your location. Consider aspects such as premiums, deductibles, copayments, protection choices, and supplier networks to select a strategy that ideal suits your health care requires.

After selecting a plan, the next step is to sign up. Medicare advantage plans near me. This can commonly be done during certain enrollment periods, such as the Preliminary Registration Duration, Annual Registration Period, or Unique Registration Duration. You can enroll straight with the insurance provider using the plan, through Medicare's i was reading this internet site, or by contacting Medicare directly. Make certain to have your Medicare card and individual information all set when enrolling. Evaluate your enrollment confirmation to guarantee all information are exact before coverage starts.

Tips for Decision Making

When evaluating Medicare Benefit intends, it is vital to carefully analyze your specific healthcare requirements and economic considerations to make an educated choice. To assist in this process, think about the following ideas for choice making:

Contrast Strategy Options: Research available Medicare Benefit plans in your location. Contrast their expenses, why not find out more coverage benefits, supplier networks, and quality ratings to figure out which straightens ideal with your demands.

Consider Out-of-Pocket Costs: Look past the regular monthly costs and think about elements like deductibles, copayments, and coinsurance. Determine potential annual costs based on your health care usage to discover the most affordable option.

Testimonial Celebrity Scores: Medicare designates celebrity scores to Advantage intends based on factors like consumer contentment and quality of care. Choosing a highly-rated plan may suggest much better general performance and service.

Verdict

Finally, understanding the eligibility needs, coverage alternatives, registration periods, and steps for enrolling in Medicare Benefit insurance coverage is important for making informed decisions. By navigating the registration procedure successfully and considering all offered info, people can ensure they are picking the finest strategy to meet their health care requires. Making informed choices during the enrollment process can lead to better health and wellness outcomes and monetary safety over time.